Investing in ranch land can be a great long-term investment – Here’s Why:

Ranch Land affords several economic advantages that other investments do not offer. They ultimately offer a wide range of potential economic benefits, whether seen as a long-term or short-term investment, a commercial enterprise, or a combination of both.

Here are some of the economic advantages associated with Ranch Land Investment:

Appreciation

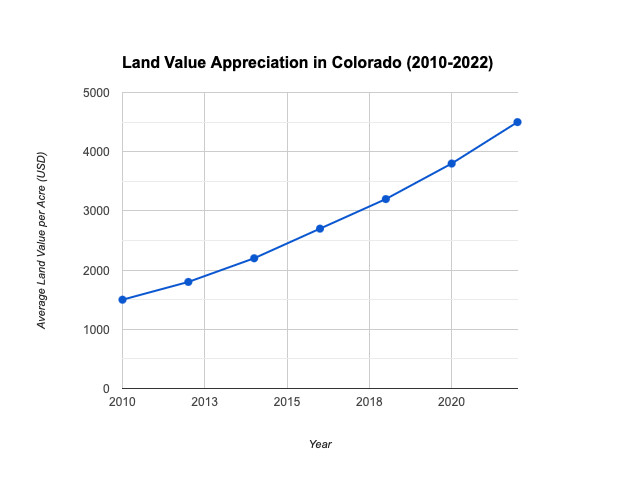

In terms of appreciation potential, ranch land regularly experiences steady increases in value due to its convenient location and characteristics including acreage, breathtaking views, and recreational opportunities.

- Historically, land has been a reliable asset that tends to appreciate over time, especially in regions with increasing demand or limited supply.

- A ranch can be a tangible asset, a legacy passed down through generations, potentially appreciating in value and providing livelihoods for descendants.

Supplementary Income

Furthermore, some ranches may come equipped with natural assets such as minerals or oil wells which can be a source of supplementary income for the investor over time.

- If not using the ranch actively, land can be leased to others for farming, grazing, or recreational purposes.

- Agricultural Revenue: If the ranch is used for livestock or crop production, it can generate regular income such as organic farming, speciality crops, or livestock leases.

- Recreational Opportunities: Ranches with recreational amenities like hunting, fishing, or tourism can generate significant revenue.

- Timber and Mineral Rights: If the ranch has timber or mineral rights, it can be a source of revenue.

- Water Rights: In some regions, water rights can be incredibly valuable. Owning water rights can allow for agricultural endeavours, and in some cases, these rights can be leased or sold at a premium.

- Potential Development: As urban areas expand or demand for land grows, parts of the ranch could be sold or leased for development, often at a premium.

Diversification

Diversifying one’s portfolio with Ranch Land can provide a hedge against market volatility, providing a safety net against downturns in other investment sectors.

- Real assets like land often serve as a hedge against inflation. As inflation diminishes the value of money, tangible assets often retain their value.

- Unlike more volatile assets like stocks, ranch land provides a tangible, stable investment that is less susceptible to rapid market fluctuations.

Tax Benefits

Additionally, ranch land in Colorado, Wyoming and New Mexico can offer many tax advantages due to IRS code section 1031 exchanges when converting appreciated assets into other types of real estate investments; under these exchange agreements, investors are capable of delaying any taxable gain until they eventually sell off the new asset(s) acquired , so long as all appropriate criteria are met for each step along the way.

- Many regions offer agricultural tax exemptions or reductions if the land is used for farming or

- ranching.

- Additionally, there are potential tax breaks related to conservation or land stewardship in some areas.

- Some landowners can financially benefit from placing parts of their ranch under conservation easements, receiving tax benefits or even direct payments.

… and many more

While ranch land investment offers numerous economic benefits, it’s essential to approach it with thorough research and a consultation with a professional broker like M4 Ranch Group who has the experience and expertise to help you find the perfect investment. Factors like location, market conditions, and the specific characteristics of the ranch can greatly influence the return on investment.

If you’re looking for any type of Ranch Land Investment in Colorado, Wyoming and New Mexico M4 are here to help.