BY LORIE A. WOODWARD

In his previous career as the owner-operator of an outfitting business that spanned four western states, Dan Murphy got involved in wildlife policy issues. The experience prompted an epiphany.

“At the time, the industry was managing wildlife for money instead of biology, so I realized we were part of the problem not part of the solution,” Dan said. “If wildlife was going to be sustainable and herds were going to be balanced, I recognized we had to focus on the foundations of what created healthy, robust herds and manage in a way that allowed them to thrive.”

Because the same understanding of broad ecological principles is essential to healthy, vigorous ranches, Dan’s epiphany has proven to be a foundational tenet for the M4 Ranch Group, and the team of professionals who work with and for M4 Ranch Group.

“The dynamics of a successful ranch lie in the nuanced interrelationship between land use, water use habitat management, wildlife management and energy,” Dan said. “When we created M4, part of our mission was to understand these fundamentals from the ground up instead of the sky down, so we could be in the best position to help our clients, whether they were legacy landowners or first-time buyers.”

From the beginning, the M4 team has pushed to be the best informed, most responsive brokerage in the Mountain West, not the biggest. In fact, the sales force numbers just four, Dan, Seth Craft, Jake Murphy, and Dominic Serna. They are backed up by a team of eight professionals who ensure that everything from graphic arts, video editing, research analysis, mapping, marketing, document preparation to closing flows seamlessly.

“We’re a group of land professionals that specializes in knowledge,” said Dan, noting that every one of the sales team has either obtained or are in the process of obtaining the industry’s highest accreditation, the ALC designation from the Realtors Land Institute (RLI).

While lifelong learning and its attendant application take time and dedication, the effort pays dividends. Over the past two years, the M4 team, with four agents working in Colorado, New Mexico and Wyoming, has closed north of 200 mountain properties totaling more than $400 million in sales, proving knowledge and a lot of hard work provide a competitive advantage.

On any given transaction, brokers and their clients will likely be contending with some combination of 1031 exchanges, conservation easements, zoning requirements, water rights, mineral rights, wildlife regulations ranging from hunting units and allowable harvests to the Endangered Species Act. In recent years, renewable energy has begun to merit serious consideration and the development of ecosystem services markets may soon add another level of complexity.

“It’s impossible to know everything,” Dan said. “That’s why we make it point to know the people who know.”

A Network of Expertise

Ariel Steele, who works with the Tax Credit Connection, specializes in marketing the state income tax credits that Colorado landowners earn for enrolling their land in conservation easements. Under Colorado’s incentive system, non-residents whose primary businesses are elsewhere, can sell their credits to Coloradoans who can benefit from them.

Steele, who met the Murphys through RLI in 2015, works with the M4 team to educate the firm’s clients who are interested in conservation easements prior to a purchase. Then, if they choose to enroll their new property in a conservation easement, she markets the resulting tax credits.

“I’m probably one of at least 30 people affiliated with M4 who has a specific area of expertise,” said Steele, noting the network includes everyone from appraisers and water attorneys to wildlife biologists, construction specialists and land reclamation practitioners. “I’m honored to be someone M4 trusts with their clients because from the team’s perspective their clients are the most important piece of any transaction.”

According to Steele, M4 has an almost unprecedented commitment to conservation and keeping ranches, open and working. Landowners who don’t want to develop their properties can get somewhere between one-third to one-half of the cost back through tax benefits, she said.

“Unlike many brokers, they will talk people’s ears off about the benefits of conservation in general and conservation easements specifically,” Steele said. “If a broker doesn’t tell a client about conservation easements that’s a big chunk of money left on the table.”

Another way M4 increases its knowledge of properties and opportunities is by assessing and adopting new technology such as Landgate. Landgate’s proprietary software harnesses the power of data intelligence to allow land professionals and landowners to discover the true value of land by assessing its potential for assets on the land, under and above.

Craig Kaiser, Landgate’s Co-Founder and President introduced Dan and the M4 team to his company’s technology about a year ago. According to Kaiser, Dan immediately saw how the system could help grow M4 and signed up on the spot.

“Our system gave them data, they didn’t have before,” Kaiser said. “Previously, the team was considering land through two or three lenses, with our tool they can consider it through five or six. It allows them to be the best educated on either the buying or selling side of the equation.”

Knowing there would be a learning curve, Dan arranged to have the team trained sooner rather than later, so they would be among the earliest adopters in ranch real estate. These days, the M4 team runs every property they list or find for a buyer through the program.

“They simply want to stay at the tip of the spear and be industry leaders in all facets of their business,” Kaiser said. “If they determine something like our system makes sense for them and their clients, they adopt it early and use it to their competitive advantage.”

The M4 team is also always on the lookout for potential solutions for client’s problems. For instance, in many long-time ranching families, the current generation of owners is reaching retirement age and their children have no interest in actively managing the land. If the family chooses to sell and have not planned for that moment, they face a huge tax bill because of capital gains.

Two years ago, the M4 team found a workable solution through Brad Watt and his team at Petra Capital Properties.For the past 35 years, Watt and his team have specialized in structuring tax efficient real estate investment programs, including 1031 exchange programs known as Delaware Statutory Trusts (DST).

DSTs are turn-key 1031 replacement property interests that allow individual owners to sell highly appreciated land or other rental property and reinvest sales proceeds into a portfolio of passive income and growth properties. Passive DST replacement property interests can be combined into highly customized and diversified real estate portfolios and tailored to meet each investor’s risk tolerance, cash flow requirements, and overall investment and estate planning goals. DSTs are offered as real estate securities and represent all major asset classes and diverse investment strategies.

“Our clients have worked a lifetime to accumulate wealth,” Watt said. “Now, they are in a season of life where they want to compound wealth through 1031 tax deferral and convert highly appreciated property into diversified streams of projected passive income.”

Additionally, if the land is sold prior to the parents’ passing, the children can inherit an income-producing portfolio. As real estate securities, DSTs may be easier to transfer than a ranch or a business.

Recently, Seth Craft of M4 and Petra teamed up to help an 80-year-old widow in Colorado. She had been running the family farm since her husband’s passing 20 years ago and was ready to retire. Her children did not want to continue its active management, so she trusted M4 to sell a portion of the property.

Upon closing, Petra’s team reinvested the sales proceeds into a portfolio of diversified DST properties, customized to match her risk tolerance and income needs. Because the properties are already identified and structured, the client’s money was reinvested within 10 days with projected cash distributions starting the following month.

Today, she continues to live in the house she shared with her husband and children. Once a month, she anticipates receiving a monthly check from her diversified DST property investments.

“Good deals are easy if you know what you’re doing, but good partnerships are rare,” Watt said. “Petra and M4 are good partners because we’re mission-focused and client-centered. Our core values align, so we’re equally yoked and pull in tandem for the benefit of our clients.”

Real Knowledge, Real People

Having access to the best knowledge, tools and technology, means nothing if they can’t be applied. At M4, the team puts their resources on the ground with the same commitment they put their boots on the ground. It works. The following samples are just a few from the vast collection of success stories they’ve amassed in recent years.

A Penchant for Fixer-Uppers

For Marv Peachey, an Iowa-based building materials entrepreneur, a disappointing elk hunt turned into an unanticipated opportunity.

In September 2021, Peachey, an avid hunter, was pursuing elk in Colorado. While the hunting was poor, his guide was stellar. Knowing that Peachey was interested in acquiring a hunting lease for himself and his company’s team on private lands, the guide suggested he meet Seth. When the hunting hadn’t improved after several days, Peachey agreed to leave the field and the guide arranged a lunch with Seth.

While Seth didn’t know of any lease opportunities that would meet Peachey’s needs, he did have a suitable 3,400-acre ranch in Guffey, Colorado, that was for sale. Although Peachey wasn’t in the market to purchase a ranch, he ran the proposal past his CFO and his banker but told Seth it was a long shot at best.

Much to his surprise, his banker and CFO both gave the proposal a thumbs up in short order. Within a few days, they had a contract.

“My team and I love to buy properties, fix them up and then put them back on the market,” Peachey said. “We have a full complement of heavy equipment and a lot of ambition.”

Before Peachey’s team had finished cleaning up the property, Seth had it under contract. Since then, Peachey and his team have bought four additional ranches and sold two of them, all with M4. The two remaining properties will hit the market this spring.

“The number one core value for our manufacturing company is positive energy and I sensed that from Seth and Dan,” Peachey said. “They are always upbeat and maintain the mindset that the next deal will be a good one. It’s a pleasure to do business with people who work hard because they are driven by a passion for what they’re doing instead of a feeling of obligation.”

While Peachey values energy and hard work, he credits trust as the foundation for their ongoing business relationship.

“After all these years in business, my hypocrisy alarms are fine-tuned, but when I encountered M4 the alarms didn’t go off because folks were honest, sincere and transparent,” Peachey said. “If there were ever a mistake made, I honestly believe that they would lose money on a deal just to make it right instead of passing it on to me.”

Hunting a Remote Opportunity

Chris DeBow, who lives in Cincinnati, Ohio, and is a senior-level investment manager, has traveled to all 50 states. He’s hunted and fished in 28 states, so when he chose Colorado as the location for his hunting property it was an informed choice.

In 2019, M4 had listed the apple of his eye, a remote 923-acre seasonal ranch that was accessible only by snowmobile during the winter. When DeBow’s wife saw a nearby shared ranch property listed by M4, she was smitten. She wanted a “civilized place” in Colorado that she and their four children could enjoy before they acquired the hunting ranch.

The DeBows purchased the shared ranch estate. Once the family was settled, they purchased the hunting property. The transaction was completed pre-COVID and the ensuing market rise. Then, after the market had begun to heat up, M4 helped attain some key missing pieces and the DeBows purchased an additional 350 adjoining acres.

With his eyes on the rising market and complete lack of supply, Dan suggested DeBow consider the selling the property. DeBow wasn’t interested until last spring, when M4 brought an opportunity—a buyer in need of a 1031 exchange who offered DeBow about double what he had paid for the properties. DeBow refused but agreed to list it at $1 million over the offer just to test the market. The property sold for $100,000 less than listing and DeBow secured exceptional revenues while maintaining exclusive hunting rights for five years.

“A rural land deal is a complicated undertaking, and you need people who know what to expect, how to spot the pitfalls and where to find the answers and solutions,”

Chris Debow

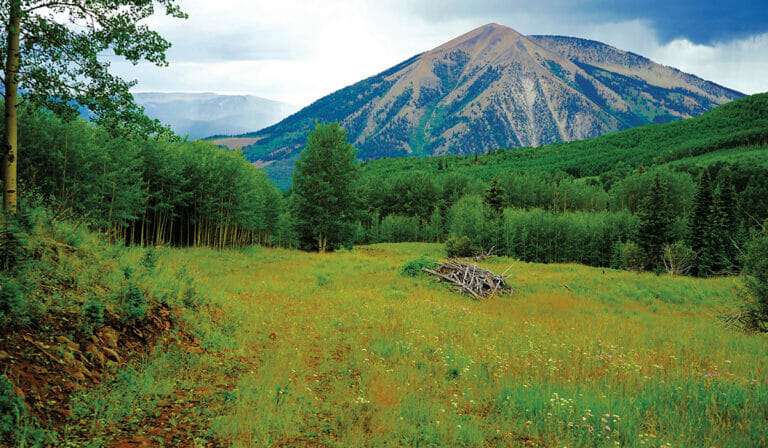

Whetstone Mountain Ranch, elk hunting at its best in the Colorado Rockies.

“A rural land deal is a complicated undertaking, and you need people who know what to expect, how to spot the pitfalls and where to find the answers and solutions,” DeBow said. “Dan and the M4 team know the region where they work like the back of their hands because they live it.”

In the process of his transaction, M4 and legal counsel had to contend with water rights, severed mineral rights and remoteness surveys in anticipation of a conservation easement.

While experience on the ground is invaluable, experience at the negotiating table can’t be overlooked. According to DeBow, the M4 team’s track record with transactions that regularly exceed $30 million benefited him.

“When negotiating big deals temperament is a factor,” DeBow said. “People who don’t have experience working with deals of that magnitude can lose their perspective and get flustered. Dan and his team are cool as cucumbers.”

Divide and Conquer

Bryan Mick, an attorney living in Cody, Wyoming whose Omaha, Nebraska-based firm specializes in due diligence on investments in real estate and other assets, has a couple side hustles.

“One strategy is buying large tracts and dividing them,” said Mick. Mick also manages three LLCs which originate sale/leaseback and “hard money” transactions. His entities have used Seth and the M4 team to liquidate assets, find undervalued buy and hold recreational ground, and complete IRS Code Section 1031 exchanges, in one case into an industrial flex condominium unit. The deal size has ranged from $400,000 to $7 million, with Seth as his primary agent.

Like all real estate deals, each transaction is different. In one, he purchased 600 acres adjacent to the Black Canyon of the Gunnison National Park and later created a large lot development. The anchor parcel was 400 acres under a conservation easement, so it sold intact with a building envelope already reserved, and the remainder was divided into 35-acre large lots, all of which sold. In another, he assembled contiguous parcels to create a ranch in New Mexico, which is on the market now.

In his primary job, Mick represents broker-dealers and registered investment advisors from across the nation, analyzing syndicated real estate offerings involving development, Section 1031 DST programs, REITs and real estate debt funds. When it comes to his personal business, however, he relies exclusively on the M4 team for Colorado and New Mexico farm and ranch transactions.

In his estimation, the M4 team excels at assessing the embedded value of any property’s features, whether it’s the hunting opportunities or water rights. They have a collective, creative vision for different land configurations and improvements that allow the owner to achieve its highest and best use. According to him, the team also finds value where others miss it.

“Also, sometimes they’ll find an expired listing, talk to the seller and figure out what prevented it from selling,” Mick said. “Then, they rectify the problem and make it happen.”

As a seller, Mick also appreciates M4’s realistic, unvarnished view of a property’s value in the marketplace. In his experience, some brokerages acquiesce to their clients’ pie-in-the-sky view of their property’s value, setting their expectations too high from the outset. When the listing price is based on wishes instead of market data, the property often undergoes a series of price reductions and languishes on the market.

“At that point, you have a seller who is upset and an asset that may have precluded early potential buyers because they didn’t want to make an ‘insulting’ offer when, in fact, their offer might have been true market or even a little above,” he said.

The final differentiator for Mick is the M4 team’s ethics and the quality of people they surround themselves with.

“They have the highest ethics I’ve encountered in the marketplace and they’re careful about who they associate with internally,” Mick said. “If they recommend someone from their network of contractors and service providers to do a job, I can proceed with confidence because they only deal with the best.”

“If they recommend someone from their network of contractors and service providers to do a job, I can proceed with confidence because they only deal with the best.”

Bryan Mick

Rio River Ranch, sitting along 2.600± feet of gold medal trophy trout waters of the Rio Grande River.

Wild Open Spaces

Entrepreneur and avid bowhunter Andrew Richardson, who is based in Orem, Utah, wanted a ranch to diversify his multi-state pest control company’s holdings. Beginning in 2021, he searched in Montana, Wyoming and Colorado. During his search, he worked with different brokers and then he met Dan.

“Everybody else was nice, but Dan is a charismatic, captivating individual,” Richardson said. “His superpower was that he read my mind and knew exactly what I wanted. He took me to two and I bought one.”

Before he made his final decision, Dan talked him through the advantages and disadvantages of both properties. In the end, Dan recommended the property that cost less, but delivered the bigger bang for wildlife habitat and hunting.

“He knew how to present the property, so it connected the dots for me,” Richardson said. “For him, it was all about getting the right fit for me.”

The 3,800-acre property, located about 40 miles west of Telluride, sits on an elk migration corridor. During the height of the migration, elk number in the thousands.

“Finding this property was like finding a needle in a haystack—and he found my needle,” Richardson said.

As the transaction proceeded, the M4 team assured Richardson that they’d assist him after the sale. He admits that he thought that was an empty promise and that he underestimated their commitment.

In the year since the sale, Dan has helped Richardson establish a bow-only hunting protocol for the ranch and suggested setting aside a 600-acre sanctuary where elk are unmolested, so they will continue to return to the ranch even during hunting season. He also helped Richardson acquire bison, which ensure the benefits of agricultural tax valuation, add another huntable species and create a panorama reminiscent of the pre-settlement West.

“His approach to helping me manage the land is not pushy or overbearing,” Richardson said. “He’s driven by a passion for conservation and wants to help me be the best land steward I can be.”

Along the way, Richardson has become close friends with Dan, Jake and Seth. From his perspective, it’s the team’s dedication to building lasting relationships that has elevated the entire experience.

“From the moment I first walked in, nothing has felt like customer service, instead it’s felt like friendship,” Richardson said. “From a business perspective, that’s the highest compliment I can give anyone.”

An Apex Consumer

Bradford “Brad” Griffith operates his Lubbock, Texas-based construction and residential waste business from Dallas, but he relaxes in Colorado. He met Dan in 2004.

In 2008, Griffith began looking for a property that offered recreation just outside his dream home’s door. His first purchase was a parcel that had .6 of a mile of private river frontage. Dan and his network helped construct an 18-foot-deep pond with continuous freshwater flow that could sustain fish through the winter. Griffith planned to build a home on the property.

Then, a premier parcel, a peninsula with an island jutting out into the lake that gives Lake City its name, became available. The views of the surrounding mountains and their reflection off the surface of Colorado’s second largest naturally occurring lake are unsurpassed. Dan brought it to Griffith’s attention.

The iconic property was too beautiful to pass up, so Griffith purchased it and began plan his dream home for the peninsula. He enrolled the peninsula in a conservation easement which limited the number of building envelopes from three to one and added strict covenants governing the type of structure that could be built.

With the purchase of the river property, then the peninsula, and after the construction of a boat house and suspension bridge to the island, Griffith needed to postpone building his house. Instead, he purchased and remodeled one sitting on the lake that had originally served as M4’s first office. It is still known as the “Tack Shed.”

“And to make it even better, what began as business transformed into deep, lasting friendships. The M4 team, like me, appreciates excellence in everything.”

Bradford “Brad” Griffith

Black Canyon overlook, is a high mountain recreational property with the black canyon of the Gunnison National Park and Blue Mesa Reservoir close by.

At this point, he was pleased with both his acquisitions and knew he’d be happy building on either the river or the peninsula. He put them both on the market, determining he’d live on the one that didn’t sell.

Timing is everything and the recession of 2008 hit. Sales languished. Griffith ended up holding onto all the properties for an extended period. When COVID gripped the world in 2020, they expected nothing would move. Of course, the opposite happened. Suddenly previously undiscovered communities like Lake City were highly sought after locales.

First, Dan encountered a local resident and close friend who was looking for place to take his grandchildren fishing. The river property fit the bill. With that sale in the works, Griffith put his lake house on the market, which went under contract immediately. Then, he contracted his architect to design his dream home on the peninsula.

Before they could break ground, a county commissioner from Hinsdale County approached him about purchasing the peninsula for public use. The county was seeking grant funding to cover the cost. He agreed to give the local government an opportunity to acquire the funds.

Griffith had gone from having more property than he could use to potentially being without any. Inventory was tight, but one of the largest parcels in the Upper Lake Fork Valley was for sale. It abutted his former river property. Previously, it had been used as a summer camp. Dan had convinced the seller that splitting the camp property was the most effective way to sell the property and realize the best price. One portion had already sold.

The way which Dan had divided the property made the remaining parcel much more interesting to Griffith. What was once an adult equestrian camp remained, and its extensive infrastructure, which included a 27,000 square foot lodge, two homes and an array of cabins and camp-oriented outbuildings, was still standing. The parcel also had a pond and private river frontage. Because of the array of improvements on the site, it wasn’t a property of interest for most buyers.

Griffith asked Dan, “Why haven’t you suggested this parcel as an option?”

Dan replied, “You know when we went through that rough period and everybody was worried about being able to own their homes and keep their businesses running, the only person who felt worse than you did about your having to hold onto those properties so long was me. I thought Camp might be a good fit, but I didn’t want to put you in a position to have to hold on to something again or do anything that might impinge on our friendship.”

At that point, Griffith said, “I was instantly reminded what sort of person Dan actually is…one who would never let business get in the way of relationships or anything that wasn’t in my best interest. Good business opportunities are more common than good friends. Dan’s values mirror my own.”

Griffith gave the nod to proceed.

In the meantime, the county had received the grant. Dan, who had a long-standing working relationship with the county, began negotiations. Government wheels usually turn slowly. The owner of the camp, on the other hand, was a tough, seasoned seller and demanded a close by December 23, 2020.

“The thing about Dan and M4 is that they made it happen when I was ready to make it happen,” said Griffith, noting that having the conservation easement in place on the peninsula was a key piece because all the due diligence was already done for the county.

The county then pulled out all the stops also to meet the deadline. Michelle kept the multiple contracts moving according to our required timeline.

“As a result of everyone’s efforts, we successfully closed both transactions,” Griffith said. “It was truly a team effort.”

Six months later, as Griffith was figuring out how to dismantle the oversized lodge, Dan came to him with a lead from out-of-state buyers. They wanted Griffith’s camp property because of the big lodge that had essentially no value to Griffith. The couple wanted to remodel the lodge as their primary residence and use the two dorms for their children to create a family compound. Because of their desire to utilize the existing assets, they were willing to buy at a higher price.

It was May 2021, when land was hard to come by. Again, because of new interest in the Lake City area, almost everything had sold. But Dan knew of a parcel, the second largest in the valley, just up the river.

The property, with views of two 14,000-foot peaks, a lush meadow, and private river access and a pond is iconic—everybody in the area knows the property. It was off market, but the owners, who weren’t using it as often as they liked, were quietly looking to sell. The property had a 5,000-square-foot log home and a second caretaker’s or guest home on the opposite end of the property.

From Dan’s perspective, the camp property was a better fit for the family searching for a compound and the iconic property was potentially a better fit for Griffith. When they viewed the property, Griffith agreed, but he was tired of moving.

His instructions to Dan? “If you can figure out a way to get me in there with no out-of-pocket, I’ll do it.”

Once again, negotiations began and closed successfully. Griffith now counts the new owners of his previous properties and the former owners of his new home as friends.

He has enacted a conservation easement on his property, which was previously zoned in one-acre parcels, so it could have become an RV Park or developed with many cabins. Now, because of the conservation easement, this incredible view corridor will remain just as it is for perpetuity.

Griffith is beyond satisfied with his home place. After many twists and turns, he has his home, river and pond in one contiguous parcel that delivers magnificent views.

“Dan and the M4 team listened and knew what I wanted,” Griffith said. “They know I like apex opportunities and throughout the years didn’t present me with anything that was not the absolute definition of that. Each transaction led to a favorable outcome for me and others, be it the owners of my previous properties and especially Hinsdale County by enabling her residents and visitors to enjoy the peninsula, the island and Lake San Cristobal more completely.

“And to make it even better, what began as business transformed into deep, lasting friendships. The M4 team, like me, appreciates excellence in everything.”